Don’t Keep Cash in the Bank: The Illusion of Ownership

Putting money in a bank account with low or no interest can be disappointing. What makes it worse is that when you deposit money in a bank, it no longer belongs solely to you. You essentially give your assets to the bank in exchange for a debt claim, making you an unsecured creditor with an IOU.

Prepare for Cyprus-Style Bail-Ins at Your Local Bank

The biggest concern is the “bail-in” that happened during the 2013 banking collapse in Cyprus. Some uninsured depositors got only half of their money back. But at one bank, customers lost all of their deposits above the insured amount.

In 2014, the G20 leaders, representing the top 20 economies globally, endorsed applying the Cyprus model worldwide. More details can be found here: Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in Resolution.

Under this model, banks considered “too big to fail” will quickly recapitalize using their unsecured debt, which includes your bank deposits. Insolvent banks will convert your deposits into essentially worthless bank stock to avoid taxpayer-funded bailouts, which were unpopular during the last financial crisis.

In addition, the G20 has classified derivatives, which Warren Buffett calls “financial weapons of mass destruction,” as secured debts. Since your bank deposits are considered unsecured debt, if the bank’s bets on derivatives go wrong, your money is at risk.

The Fragility of the Modern Banking System

Despite efforts by central banks to increase capital requirements and conduct stress tests on banks to safeguard deposits in the event of a financial crisis, the likelihood of numerous bank failures remains high.

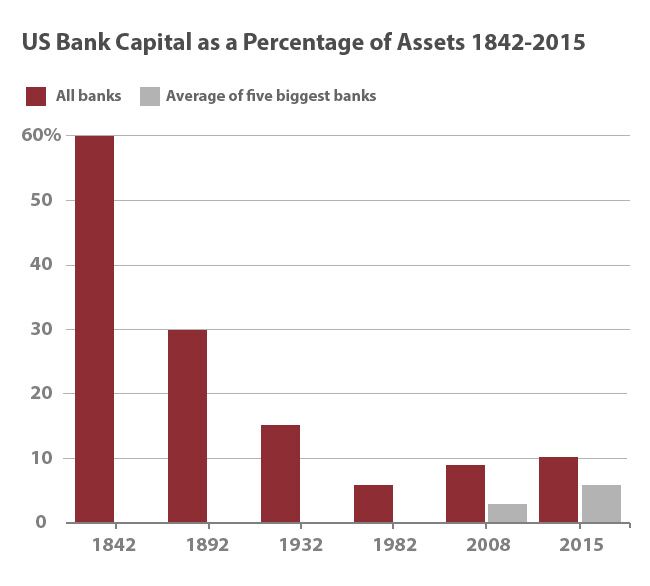

The capital reserves held by banks compared to deposited funds are alarmingly low. In the US, the top five banks have a capital ratio of only 6% of assets, although this has doubled since 2008. In a scenario where all depositors demand their funds simultaneously (a “bank run”), these banks could only repay six cents on the dollar before exhausting their resources.

Historically, US banks were much better capitalized, with an average capital ratio of 60% in 1842. This is ten times higher than today’s largest banks. That was an era in which bank competition was based on safety, because no deposit insurance was in effect.

This Chart Says it All

While many countries insure bank deposits, in the US, the first $250,000 in your account is protected by the FDIC. However, for every $100 deposited, the FDIC has only $1.06 with which to back it.

The only completely safe bank would hold 100% of each depositor’s funds in reserve as cash or highly liquid assets. This bank would provide checking accounts for a fee but would not lend out any deposits.

Mainstream economists oppose this concept, fearing it would hinder business financing and mortgage availability, leading to an economic downturn.

Contrary to this view, we believe that with the rise of online peer-to-peer lending platforms, even in a 100% reserve banking system, individuals and businesses could still access financing. These platforms often offer lower interest rates than traditional banks. Instead of collapsing, the economy could thrive.

Negative Interest Rates and the Demand for Cash

Central banks and mainstream economists thought negative interest rates and global bail-in policies would encourage consumers to invest in riskier assets and businesses to borrow more, thus boosting the global economy.

But this did not happen. Instead, the demand for cash has skyrocketed, along with the need for secure storage. In Japan, where negative interest rates were implemented last year, a popular brand of safes is sold out. In Switzerland, the circulation of the 1,000 franc note (worth around $1,000) increased by 17% in 2015 after the Swiss National Bank imposed negative rates.

This behavior deeply concerns the authorities. In response, they have imposed stricter controls on cash, aiming to force people to keep their money in banks where deposits can be easily “bailed in.”

The justifications given are to “fight crime” and “facilitate tax compliance,” such as former US Treasury Secretary Larry Summers’ proposal for a global ban on notes worth more than $50 or $100.

Despite these efforts, central banks’ attempts to spur economic growth through negative interest rates and bail-ins have not worked.

Most people are rational and respond to adverse financial incentives (like negative interest rates) by doing whatever they can to preserve their capital. They hoard cash, buy assets like gold that can’t be bailed in, and move their money to the safest possible banks.

If you haven’t already, you may want to consider taking similar steps to protect your financial well-being.

7 Ways to Avoid a Bank Bail-In

You can find more information here: How do you protect against bank bail-ins?

Here’s 5 Things You Can Do to Minimize Your Risk

- Minimize your exposure to the banking system. Precious metals are ideal for this purpose. The most secure way to own precious metals is to purchase fully “allocated” physical gold. [Here you can find more information on best gold coins to buy and best gold bars to buy.]

- Keep a healthy supply of cash at home. If your bank fails, you’ll lose the ability to withdraw cash from your accounts at an ATM. Try to store enough cash to pay living expenses for at least six months. The most secure way to keep the cash is in a floor safe encased in concrete. Keep in mind that the government considers large cash holdings evidence of criminal activity, which may subject it to civil forfeiture.

- Diversify your savings across different banks, different countries, and different currencies. In Australia and Panama, a one-year CD pays more than you can get at home. This is a start to compensate you as a bank depositor for the risk of a possible bail-in scenario.

- Keep bank balances well below the insured maximums. Use only strong, well-capitalized banks to hold the funds you keep in the banking system. In the US, one excellent bank rating system is Veribanc.

- Avoid large money-center banks. These are the banks that are most likely to be bailed in during the next financial crisis.

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk planning. To see if our planning is right for you, please book in a free no-obligation call with one of our Associates. You can do that here.