2016 Marks a New High for Americans Expatriating

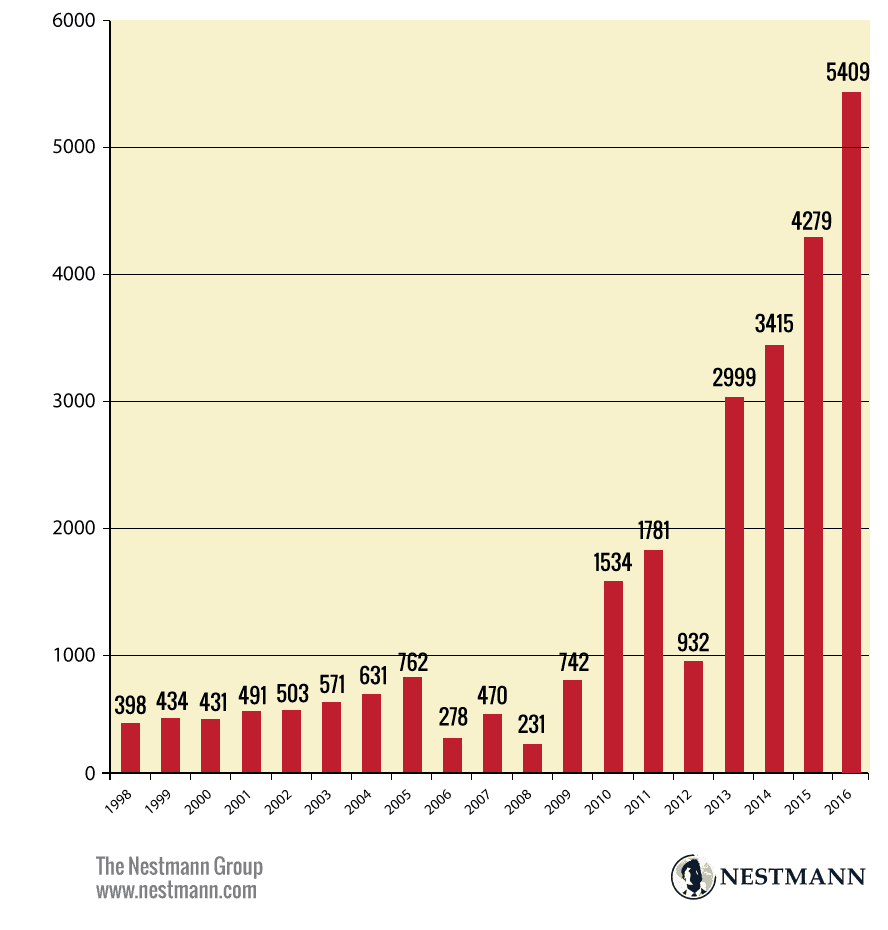

- 2016 saw a record number of US citizens and long-term residents expatriating, giving up their US citizenship and passport or green card.

- According to a February 9 announcement in the Federal Register, 2,364 people expatriated in the fourth quarter of 2016.

- This brings the total for 2016 to 5,409 expatriations. This is a 26% increase over 2015.

- The current expatriation rate is more than 13 times higher than it was less than two decades ago.

Expatriation Rates Soar, but Official Numbers May Underestimate the Trend

As high as these numbers are, we think they’re only the tip of the iceberg. That’s because of the way that the numbers published in the Federal Register are counted. Only those who formally notify the IRS that they’ve expatriated by filing Form 8854 – “Initial and Annual Expatriation Statement” – are counted.

You’re supposed to file this form if you expatriate. But many former US citizens and green card holders don’t bother. Why not? We think it’s because the form requires that you certify whether or not you have been tax-compliant for the preceding five years. There are millions of Americans – especially those living outside the US – who aren’t.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

Discrepancies in Expatriation Data

The official expatriation statistics published in the Federal Register do not tell the full story.

- The South Korean media reported that 2,158 of its citizens gave up US citizenship or green cards in 2011. In other words, more people expatriated from a single country in 2011 than appeared on the official IRS list for the entire world for that year (1,781).

- The Swiss media reported that in the first nine months of 2012, 411 individuals expatriated at the US embassy in Bern, Switzerland. This would mean that Switzerland accounted for over 40% of the total expatriations in 2012 (932).

- Many public figures never appear on the official IRS list. They include Ukraine’s former first lady, Kateryna Yushchenko (2007); Jamaican politicians, Daryl Vaz (2008), Michael Stern (2009), and Danville Walker (2011); Hong Kong actors, Jaycee Chan (2009) and Erica Yuen (2012); and Korean actor, Yoo Gun (2011), among other examples.

For all these reasons, it’s logical to assume that the actual number of Americans expatriating could be as much as five to 10 times the statistics published in the Federal Register. In other words, perhaps as many as 50,000 annually.

Reasons for Expatriation

Expatriating means giving up your right to live and work in the US. If you’re a former US citizen, it means surrendering your US passport – one of the world’s best travel documents.

So why bother? A clue comes from the fact that, at least in our own experience, the overwhelming number of expatriating Americans already live outside the US. There are more than 9 million Americans in this category.

The US is one of only two countries that impose income tax on its citizens on their worldwide income if they live in another country. Eritrea, a totalitarian dictatorship, is the other one. Complying with US tax rules is hard enough if you’re living in the US. But if you’re living in another country, you must now file two sets of tax forms each year.

Plus, laws like the infamous Foreign Account Tax Compliance Act (FATCA) have made it difficult for Americans living abroad to carry on the most basic financial and business relationships in their adopted countries. FATCA, for instance, forces foreign financial institutions to follow US tax and reporting rules with respect to their US clients. If these institutions fail to do so, they face a 30% withholding tax on many types of US source income and other capital transfers.

Often it’s easier to “fire” US clients than deal with this risk. As a result, Americans living abroad report bank accounts being closed, mortgages called in, and insurance policies canceled. One client’s employer told him he’d be let go unless he gave up US citizenship within 30 days.

It’s also nearly impossible for an American living abroad to enjoy a normal retirement in their adopted country. That’s because with only a few exceptions, the IRS considers the buildup in value in a non-US retirement plan to be taxable.

And don’t forget that if you owe the IRS more than $50,000 in back taxes, the State Department can confiscate your passport.

The costs of expatriating, though, are steep. US citizens wishing to expatriate must pay a consular fee of $2,350. That’s the highest fee imposed by any country.

Covered Expatriates

If you’re wealthy, expatriation can also lead to some unpleasant tax consequences. A 2008 amendment to the Tax Code imposes an “exit tax” on wealthy expatriates. It’s based on a legal fiction, as if you sold all of your worldwide property at its fair market value on the day before you expatriate. Tax on the fictional gain is due at the time your tax return is due for the year of expatriation.

The tax applies only to “covered expatriates.”

You’re in this category if you:

- Have a global net worth exceeding $2 million; and/or

- Have an average annual net income tax liability for the five preceding tax years before the date of the loss of US citizenship or residence exceeding $162,000 (2017, adjusted annually for inflation); and/or

- Fail to certify under penalty of perjury on Form 8854 that you have complied with all federal tax obligations for the five years preceding expatriation.

No exit tax is due on the first $699,000 of unrealized gains (2017, adjusted annually).

The 2008 amendment also results in a covered expatriate’s IRA being considered as having been closed (with taxes due) and deemed termination of similar schemes in other countries. So in addition to paying capital gains tax on imaginary capital gains, you’ll pay income tax on imaginary income. And there’s no assurance that when you actually realize the income, the country you’re living in won’t impose tax a second time.

Also, as a covered expatriate, any gifts you make to a US citizen or permanent resident exceeding $14,000 annually are subject to a tax of 40% (or the highest estate tax rate currently in effect). The recipient of the gift must report it and pay the tax.

Careful planning can deal with some of these issues. Especially if you’re a covered expatriate, be certain to consult with qualified professionals before you sign away your citizenship or green card.

How to Get a Second Passport: 7 Legal Ways

Thinking about a second passport? There are just seven official (legal) ways to get one. Find out which one is the best option for you: How to get a second passport.

Need Help?

We can assist in every phase of giving up your US citizenship or long-term residence. This includes helping you get a second passport before giving up US citizenship.

And if you’re not ready to expatriate, we can help you take advantage of tax breaks in the Tax Code that apply to US citizens and permanent residents living overseas.

Schedule a consultation with a Nestmann Associate to see if expatriation is right for you.

How to Move Out of the US Permanently… From Start to Finish.

Thinking about saying goodbye to Uncle Sam? Here’s everything you need to know about expatriation. The good. The bad. And the often unspoken.

Learn more here: How to move out of the US.