The Financial Downturn of 2022

As financial markets worldwide teeter on the edge, the stories of individual investors facing monumental losses serve as a stark reminder of the fragility of our economic systems. The financial downturn of 2022, punctuated by the collapse of Archegos Capital Management, is a case study in the vulnerabilities lurking beneath a seemingly stable economy.

Earlier in June 2022, on a day when the Dow Jones index fell more than 700 points, I ran into an old friend at a monthly dinner meeting I regularly attend.

“I’m screwed,” he told me. “My money manager has me almost fully invested in stocks. And they’ve lost almost a quarter of their value in just the last few weeks.”

The week before that, I was speaking with a client who had placed nearly all his net worth into a cryptocurrency protocol called “Anchor,” which offered interest rates as high as 20%. But its value had fallen 99.9% in the previous few weeks. “If I want a decent quality of life going forward, I’ll probably need to work until I die,” he told me.

These anecdotes are hardly definitive, but they illustrate examples of a far larger phenomenon—what we’re calling the “everything meltdown.” Whether it’s stocks, cryptocurrencies, or bonds, many stores of value or sources of income investors have relied upon in recent years have shown themselves to be highly vulnerable to downturns.

The Federal Reserve’s Role in the Financial Downturn of 2022

The price collapse in many investments is most frequently blamed on the Federal Reserve’s newfound hawkishness in raising interest rates to fight what we believe could be the worst inflation in American history.

Led by Chairman Jerome Powell, the Fed’s Open Market Committee (FOMC) raised its benchmark Federal Funds rate by 0.75% in June 2022. It was the largest rate hike since 1994 and comes on top of a 0.5% interest rate increase in May 2022. The FOMC announcement also indicated that another 0.75% increase could be coming in July 2022.

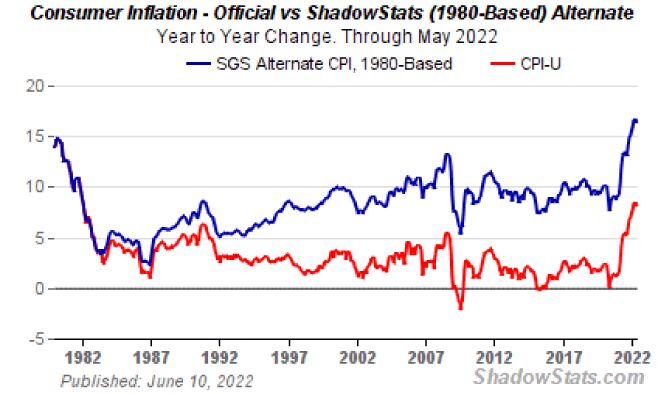

Still, even with the May and June rate hikes, the Fed Funds rate range is only 1.5%-1.75%. Meanwhile, the Consumer Price Index – measuring America’s official inflation rate – is increasing at a blazingly fast 8.6% annual rate, according to the most recent announcement from Uncle Sam. Prices rose 1% in May 2022 alone – a 12% annualized rate. Real interest rates, i.e., interest rates minus inflation – now stand at around -7%.

What’s more, if inflation were measured the same way today as it was in 1980, inflation would be running at a 17% annual clip, with real interest rates at a staggering -15%.

Inflation, Interest Rates, and the Archegos Capital Management Collapse

The Fed has been widely criticized for not increasing interest rates much more quickly than it did. Indeed, just a year ago, it was calling inflation “transitory.”

There’s another phenomenon at work here, one that the Fed doesn’t like to talk about, although it’s acutely aware of this issue. Unfortunately for the Fed – and the rest of us – the American economy has become addicted to near-zero interest rates. Both public and private debt as a percentage of GDP has climbed to record levels. Entire business models are dependent on ultra-low rates, including more than 600 zombie corporations that remain in existence only because they can borrow enormous amounts of money for next to nothing.

A now-defunct family office called Archegos Capital Management provides a great example of this strategy. Between 2012 and 2021, Archegos converted roughly $600 million into more than $10 billion. Profits this large simply aren’t possible without massive borrowing. Banks lined up to lend money to Bill Hwang, the founder of Archegos. Effectively, Archegos was employing 10:1 leverage in its portfolio.

But things began to unravel in early 2021. Prices of a few stocks in Hwang’s portfolio began to decline. When the company couldn’t meet margin calls from its lenders, the banks owning the shares Archegos controlled began to liquidate them.

Each bank was apparently unaware of the loans other banks had extended to the firm. That made the sell-off especially chaotic. Goldman Sachs, Morgan Stanley, and Deutsche Bank dumped billions of dollars of Archegos-controlled shares. In doing so, they triggered a massive margin call liquidation, in which the first sellers emerged relatively unscathed, and those who sold later bore most of the losses. Nomura, Japan’s largest investment bank, lost at least $2 billion; Credit Suisse reported a $4.7 billion loss. Archegos’ lenders may ultimately absorb $10 billion or more in combined losses.

The Broader Implications of the Archegos Capital Management Collapse

Keep in mind that Archegos is just one family office. There are at least 10,000 other family offices operating globally, controlling assets worth $6 trillion, and potentially much more. The Archegos collapse serves as a microcosm of the broader systemic risks in the financial system, where borrowed money created out of thin air, algorithmic trading, and extreme leverage can lead to catastrophic consequences.

Economist Andrea Cecci gave a good summary of the implications of the Archegos investment model:

“The Archegos case represents on a small scale how the entire economic world functions: borrowed money created out of thin air, or colossal pulverized debts, entrusted to algorithmic models managed by very powerful computers that carry out thousands of transactions per second on complicated schemes but of such size as to guarantee the multiplication of volumes thanks to the ‘Ponzi’ effect of the continuous new injection of credit/debit into the system by central and commercial banks from all over the world, in unison.”

The result of this Ponzi effect is a global financial system with multiple points of vulnerability. One in which the collapse of a relatively small family office with just a few billion dollars of capital threatened the solvency of at least eight major banks.

At the moment, we’re only in the earliest stages of a financial downturn. Unemployment remains low, and consumer spending is at near-record highs. But what will happen when a few dozen more Archegos-type operations collapse, potentially taking down with them the banks that lent them billions of dollars? Or when zombie corporations, dependent on ultra-low interest rates, begin meeting their well-deserved demise in droves?

The Fed’s Dilemma and the Future of the Financial Downturn of 2022

At that point, we believe the Fed will capitulate on inflation. Pundits call it the “Fed put.” Essentially, it’s the reality that the Fed will always intervene in the markets if prices fall beyond a predetermined point.

We’ve seen proof of the Fed put repeatedly in the last 35 years, most recently in the early days of the COVID pandemic. Every time banks, hedge funds, or other well-connected Wall Street institutions are seriously threatened by some sort of economic calamity, the Fed steps in to save them.

So, even with real interest rates at -7% (or -15%, depending on how you measure inflation), we don’t take the Fed seriously at all when it talks about tamping down inflation. When push comes to shove, it will push down interest rates, use quantitative easing to buy trillions more of dodgy debt to add to its balance sheet, and take other emergency measures to prop up the markets.

The problem, though, is that these measures are inherently inflationary. Thus, we believe that far from ending, we are only in the beginning stages of what we foresee as a hyperinflationary economic collapse.

How to Prepare for the Financial Downturn of 2022

The question we get a lot from clients is, “How can I best prepare for this scenario?” And while we’re the first to admit we can’t predict the future, we can take some comfort in owning significant quantities of an asset with a 5,000-year track record of holding its value in economic turmoil.

We’re speaking, of course, of gold. While the gold price hasn’t been untouched by the market turmoil in recent months, it has held its value far better than other assets. For instance, since the beginning of the year, gold has actually gained about 1%, compared to a loss of 23% for the S&P 500. Long-term Treasury bonds have fared even worse; they’re down 24% for the year. Meanwhile, bitcoin is down -55% so far in 2022.

And it’s not hard to see why. In times of crisis, both individuals and institutions buy gold. And there’s a new incentive for doing so: the realization that accounts denominated in the world’s reserve currency – the US dollar – can be frozen at any time. That’s a $284 billion lesson that Russia learned in the early days of its invasion of Ukraine.

For instance, in 2021, global central banks purchased a net 455 tons of gold, nearly double the 2020 total. And they’re on target to buy even more in 2022.

The last time inflation approached the levels we are seeing today in the United States, in 1978-1980, gold prices rose from $161.10 per ounce to $594.90 per ounce, briefly peaking at nearly $850 per ounce in early 1980. And this was at a time when inflation measurements were much more honest than they are today, and real interest rates were much higher.

How high will gold prices go in this round of inflation? We don’t know, but we’re glad we own a generous amount of it.

Recommended Reading

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk domestic and offshore planning. To see if our planning is right for you, please book a free no-obligation call with one of our Associates. You can do that here.