NFT Investment: Is This the Next Big Financial Bubble?

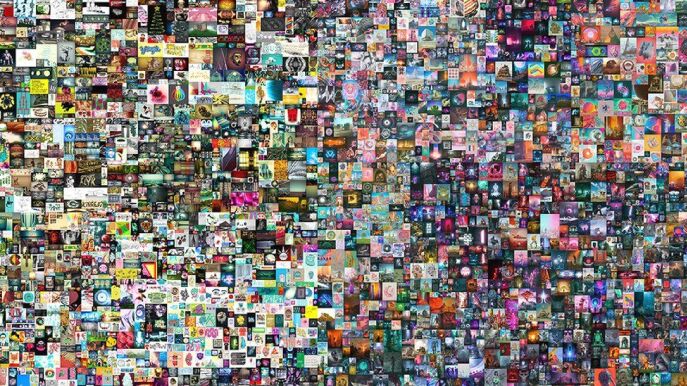

Would you pay $69.3 million for this image? A hedge fund financier who goes by the handle “Metakovan” did last month at a Christie’s auction.

In case you’re wondering, the image is a collage of 5,000 drawings made over the past 13 years by Mike Winkelmann, a digital artist who calls himself “Beeple.” It’s called Everydays — The First 5000 Days.

The digital file Metakovan purchased is unique. It was created or “minted” in February as a “nonfungible token,” or NFT. The one-of-a-kind file is stored on a blockchain network, ensuring its authenticity. Any changes in ownership are recorded on an immutable digital ledger, which can be verified by those with the technical know-how.

Both the uniqueness of the NFT and its chain of ownership are verified in the blockchain. However, since NFTs are unique and irreplaceable, they’re “nonfungible.” Unlike dollars, euros, or for that matter, bitcoins, they’re not identical to each other and thus can’t be easily traded or exchanged through commercial transactions.

Why Pay $69.3 Million for an NFT Investment?

Even if you wouldn’t pay $69.3 million for this NFT, a hedge funder did. The question is: what could motivate anyone, no matter how wealthy, to part with $69.3 million in exchange for an intangible asset that exists only in electronic form?

According to Metakovan, who was interviewed after the purchase, the answer to this question is obvious. “I think this is going to be a billion-dollar piece,” he said in the interview. And he didn’t overpay for the piece based on economic theory, because a “fair price” is the amount a buyer is willing to pay and a seller is willing to accept. Whether the rest of us think he overpaid for the asset is irrelevant.

Nor was Metakovan alone. A Christie’s spokesperson reported that 33 active bidders were trying to buy Everydays. Once the auction was complete, Beeple’s creation had commanded the third-highest auction price in history for a living artist.

The Economics of NFT Investment

There’s also a concept called “utility” in economics. It refers to the incremental satisfaction someone receives from buying or consuming goods or services. Economic transactions only occur if both parties are convinced they will each benefit from them. In the context of an asset purchased as an investment, “benefit” means believing the asset will increase in value.

Thus, we know that not only Metakovan but also at least 32 other wealthy people or institutional investors believed they would receive a benefit—most likely an eventual profit—by spending millions on an NFT investment.

For the sake of comparison, here are some other investments you could buy with $69.3 million:

-

193 single-family homes sold at the average US price of $358,800 in March 2021.

-

38,786.59 ounces of gold, based on the closing price of $1,776.70 on April 22, 2021.

-

A one million square foot warehouse in Troutman, North Carolina, which Walmart purchased last fall for $69 million.

-

312 Lamborghini Urus cars (the least expensive Lamborghini model), with a base price of $218,009 plus a $3,995 delivery charge.

But Metakovan believes that Everydays and other digital assets in his hedge fund will be a better investment than single-family homes, gold, a huge warehouse, or a portfolio of luxury cars. And even if we disagree with his logic, we can’t argue that $69.3 million isn’t a fair price…because that’s what he was willing to pay.

The Economic Conditions Fueling NFT Investment

What economic conditions created an environment where Metakovan and dozens of other investors were willing to spend millions for an asset with no physical form and no practical use?

To answer that question, we’d take a hard look at the fundamentals of the global economy. And the centerpiece of that economy is debt. The world is awash in debt, and there’s more borrowing ahead. In 2020, individuals, businesses, and governments borrowed $24 trillion, bringing global debt to an eye-watering total of $281 trillion. That represents more than 355% of global GDP.

This increase in debt picked up pace in 2020, a consequence of the global battle against COVID-19 and the economic relief measures put in place to soften the blow from lockdowns, travel restrictions, and border closures. Nowhere can we see this more clearly than in the United States. At the end of the 2020 fiscal year (September 30, 2020), Uncle Sam was in hock for $26.9 trillion—up $4.2 trillion from the year before. By the first week of April 2021, the debt increased another $1.2 trillion, rising to $28.1 trillion.

And this gargantuan number doesn’t include the “small” matter of Uncle Sam’s nearly $240 trillion in unfunded liabilities—promises made to federal pensioners, Social Security recipients, Medicare beneficiaries, and others—with no current funds allocated to pay them. That’s eight times the national debt.

Low Interest Rates and High Inflation: A Recipe for Asset Bubbles

Not that long ago, the Treasury would sell its debt at regularly scheduled auctions. But more recently, that’s become a problem, because fewer people are willing to buy it.

It’s not hard to see why. Interest rates are at their lowest level in recorded history—more than 5,000 years in all. The yields on the shortest-term Treasury bills—one or two-month maturities—are hovering at 0.02%. Even the 10-year Treasury Note is yielding only 1.6%.

Meanwhile, the Consumer Price Index, the most closely watched measure of inflation, is rising at the fastest rate in nine years. In March 2021, it rose 0.6%. This means the official rate of inflation—which we believe is greatly understated—is now running at 7.2% annually. Anyone foolish enough to purchase Uncle Sam’s debt is guaranteed to lose money.

Another possible consequence of higher inflation is a sinking dollar, especially if interest rates don’t increase to help offset it. Indeed, while the Consumer Price Index rose only 1.4% in 2020, the US Dollar Index, a trade-weighted measurement of the dollar’s value against a basket of major currencies, fell more than 7%. (Although we believe the CPI vastly understates real inflation as measured by a fixed basket of goods and services.)

So who’s buying all this debt? A lot of it is being slurped up by the Federal Reserve, which doubled the size of its balance sheet in 2021. Currently, the Fed holds nearly $5 trillion in Treasury securities on its balance sheet that no one else wants to touch with a 10-foot pole.

And there’s no end in sight. President Biden wants Congress to enact a $2 trillion “infrastructure plan.” That means more debt, more inflation, and a sinking dollar.

Choosing the Right Investments

In this scenario, investing in NFTs doesn’t sound crazy at all, even if they’re not assets we’d choose personally. Instead, we’re partial to precious metals and believe that the “Permanent Portfolio” concept developed by the late Harry Browne still makes sense. We also think it’s prudent for every American who can afford to do so to set up a financial footprint outside the United States.

Finally, we like the idea of stockpiling real goods you know you’ll need in the future since their prices are almost certain to continue going up. Why not put your depreciating dollars to work by buying things you know you’ll need in the future—and not NFTs?

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk domestic and offshore planning. To see if our planning is right for you, please book in a free no-obligation call with one of our associates. You can do that here.