Charitable Remainder Trust: What it is and How to Use it

-

Written by Brandon Roe

- Reviewed by Mark Nestmann

-

Updated: April 22, 2025

Contents

- What is a Charitable Remainder Trust?

- CRTs Have Two Flavors

- #1: Charitable Remainder Annuity Trust (CRAT)

- #2: Charitable Remainder Unitrust (CRUT)

- How Does a CRT Work?

- An Example

- Key Benefits

- Reasons Not to Do it (The Cons)

- What Kind of Assets Can You Put In?

- Pitfalls

- FAQ

- Is a Charitable Remainder Trust Right for You?

But misuse of trusts is perhaps the second most common. Charitable Remainder Trusts in particular.

When used responsibly, a Charitable Remainder Trust, or CRT, can be a very useful tool. It provides you with an ongoing income stream (usually for retirement) in a tax-efficient way that also benefits the charities you care about.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

But you have to follow the rules to make it work. This article will help you do so.

What is a Charitable Remainder Trust?

A Charitable Remainder Trust (CRT) allows you to gift assets to an irrevocable trust that pays you or others an income for a set time. After that, the remaining assets go to a charity you choose. When setting it up, you can deduct some of the value of the property donated to the trust from your taxable income.

As well, you avoid paying immediate capital gains tax if you donate appreciated assets. What’s more, the assets donated to a CRT are no longer part of your estate, which means they won’t be potentially subject to estate tax.

In short, a CRT helps you support a cause you care about while providing income and tax savings. It’s a way to balance your financial needs with giving back.

CRTs Have Two Flavors

#1: Charitable Remainder Annuity Trust (CRAT)

You transfer assets and receive a fixed annual income for life or a set period (up to 20 years or your lifetime), with the remaining assets going to a charity. The income amount (at least 5% per year) is set when the trust is created and doesn’t change, making it predictable.

CRATs offer tax benefits, including an immediate income tax deduction and deferral of capital gains taxes if you donate appreciated assets. They are ideal if you want stable income while supporting a charity.

However, CRATs don’t adjust for inflation, so the purchasing power of the payment decreases as inflation rises over time.

Promoter Scam

You may have heard that Charitable Remainder Trusts can be used to eliminate capital gains tax, which isn’t true. But people like the idea and have been tricked into setting things up the wrong way by unscrupulous promoters. This, in turn, has drawn the attention of the IRS.

If you go this way, it’s critical to work with a tax expert. Avoid the promoters.

#2: Charitable Remainder Unitrust (CRUT)

You donate assets and receive annual income based on a set percentage of the trust’s value (again, at least 5% annually), recalculated each year. This allows your income to grow if the trust assets increase in value, offering some level of inflation protection.

At the end of the trust term (either up to 20 years or your lifetime), the remaining assets go to your chosen charity.

CRUTs also provide tax benefits, including a partial income tax deduction and deferred capital gains taxes on appreciated assets.

They’re ideal if you want flexible income tied to market performance while leaving a meaningful charitable gift.

Which one is better?

The choice between a CRAT and CRUT depends on factors like whether you want predictable or flexible income, whether you can tolerate fluctuating payments from year to year, whether you are trying to protect against inflation, how long you plan to contribute, how much you’re contributing, and your tax goals.

Unless you’re an expert in such things, you’ll want to work with an expert to see how this might fit into your plan. We can help, of course. It starts with a consultation with one of our Senior Associates.

How Does a CRT Work?

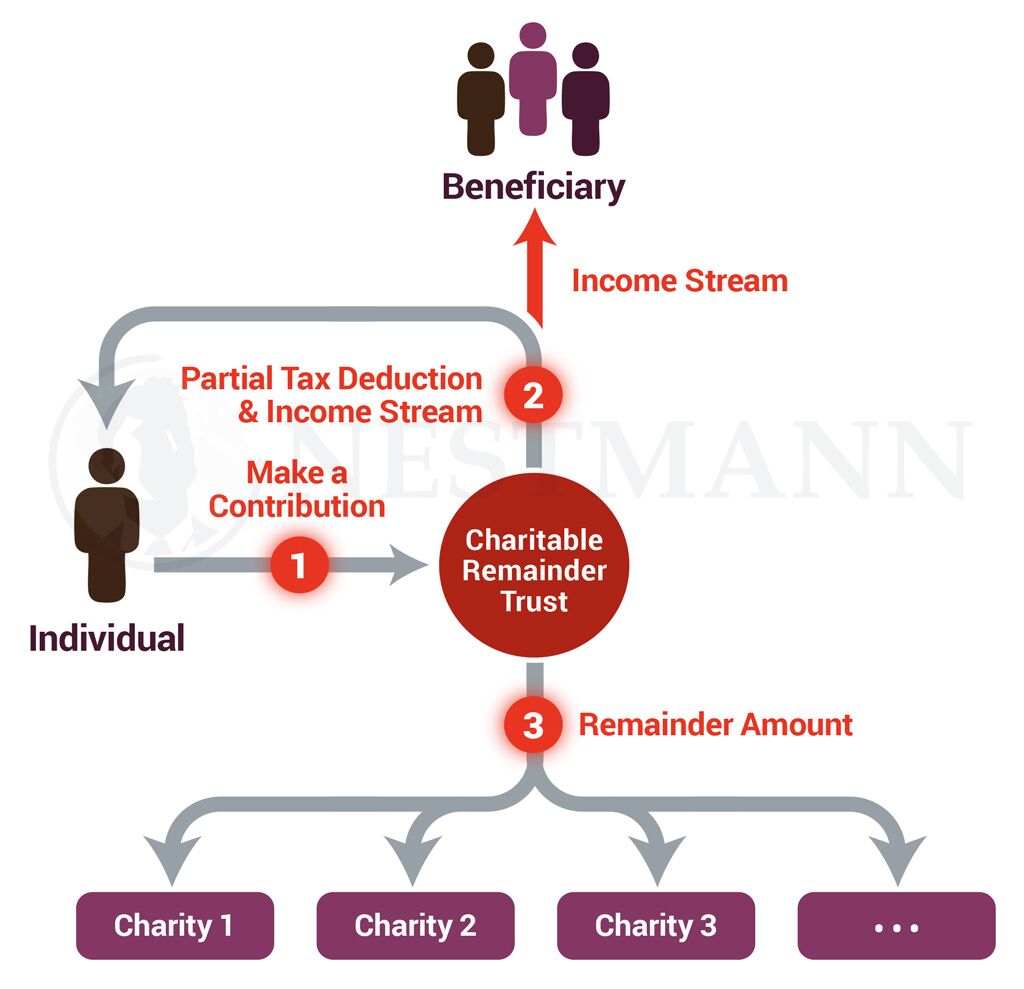

Here’s a helpful diagram to show how money flows within this structure.

An Example

To make this easier to understand, let’s work with a (fictitious) example.

Setup: Sarah funds a CRUT with $1,000,000 in appreciated stock. The trustee of the CRUT sells the stock and reinvests the proceeds into diversified investments (e.g., bonds, dividend-paying stocks). Since the CRUT is tax-exempt, there are no immediate capital gains taxes on the stock sale. A minimum of 10% of the present value ($100,000) will eventually need to go to charity to comply with the rules.

Choosing Her Payout: Each year, Sarah chooses to receive 5% of the trust’s value, paid once per year at the end of the year. (This percentage is set during setup and cannot be changed later.) The payout amount changes based on the trust’s value, which fluctuates with market performance. This is the CRUT variation mentioned above. Let’s assume the portfolio grows by 6% a year for simplicity.

DISCLAIMER: Returns vary, and real-world performance may be higher or lower depending on market conditions. For simplicity, we’ve used a consistent return in this example.

Payout Year One: At the start, the trust has a value of $1,000,000. Over the year, it grows to $1,060,000. At the end of the year, Sarah receives her 5% payout—$50,000—reducing the trust balance to $1,010,000.

Payout Year Two: Although not paid until the end of the year, her 5% payout is calculated on January 1. Based on a balance of $1,010,000, her payout will be $50,500. Over the year, the trust grows by 6%, resulting in a balance of $1,070,600 at year’s end. Sarah then receives her payout of $50,500, reducing the balance to $1,020,100.

… and so on.

Trust Wrap Up: Let’s assume the trust is set to terminate after 20 years, with the remainder going to charity. Based on the initial rule, at least $100,000 must go to charitable causes.

Based on the return which has greatly benefited from tax-deferred gains, the charities will, in fact, get much more — roughly $1.2 million.

Key Benefits

You get regular income for a set time.

Upon transfer of assets into the trust, you receive an immediate partial tax deduction.

Income or gain within the trust is tax-deferred.

You reduce your taxable estate, which can lower estate tax. If you’re looking to expatriate, this also reduces the size of your estate for covered expatriate status.

You leave a lasting gift to a cause you care about.

However, to realize these benefits, everything must be done correctly—especially if you’re looking for tax advantages. Much like threading a needle, the IRS provides a narrow path to do such things in a compliant way. But it’s on you and your advisors to know what the rules are and how to follow them.

Reasons Not to Do it (The Cons)

Every planning tool has pros and cons. Charitable Remainder Trusts are no exception. Here are some of the biggest drawbacks:

Once assets are placed in the trust, you can’t take them back.

They can be expensive. You have setup costs, appraisal costs (depending on asset type going in), and extra accounting fees. You will also need a trustee, although you can serve as one yourself to avoid that cost. You may also want to have an investment manager take over the day-to-day management of the assets within the trust.

If you choose a Charitable Remainder Unitrust (CRUT), payments depend on asset performance, which could go down (i.e. market risk). If you opt for a Charitable Remainder Annuity Trust (CRAT), you’re exposed to inflation risk.

You have to donate at least 10% of the market value at time of set up to a legitimate charity when you pass (the remainder interest). This portion will not be available to your surviving family members or other non-charity beneficiaries.

What Kind of Assets Can You Put In?

You have a fair bit of flexibility but not as much as with other structures (including other trusts) Here’s what’s possible:

Cash: Money from bank accounts (domestic or foreign) is simple to transfer and provides liquidity for payouts.

Real Estate: Domestic or foreign properties can go into a CRT, but they must be free of debt and should be reasonably liquid.

Precious Metals: Assets like gold and silver can be included but require proper valuation and storage planning.

Cryptocurrency: Digital assets like Bitcoin can be used, though their volatility can complicate matters. Moreover, IRS guidance is currently unclear on certain aspects.

Investment Accounts: Stocks, bonds, and mutual funds are common CRT assets, especially if they have appreciated in value.

Business Interests: LLC, C-Corp, or S-Corp shares, as well as international business interests, can be transferred. However, liquidity and compliance can be an issue. Expert advice is needed.

Vehicles and Other Large Assets: Boats, planes, or other high-value items can go in, but depreciating assets can create challenges. Liquidity can also be a problem. More than that, you will lose all rights to use these assets personally.

Pitfalls

Like any advanced planning strategy, it’s easy to get stuck in the mud. Here are the most common pitfalls we see when working with clients:

#1. Poor Asset Selection

We work with many clients who have significant domestic and international real estate. Property can indeed be conveyed to a CRT but doing so can complicate funding, create tax issues, and lead to poor overall returns if not planned properly. The same is true for private businesses.

#2. Overly High Payout Rates

This is more of a financial planning issue than a structural one. Sometimes people set the payout rate too high—either because they contributed too little to start with or because their lifestyle needs are too great to optimize the tool.

Either way, they may deplete the trust, leaving little to no remainder interest for the chosen charity. This shortfall can lead to significant tax complications.

#3. Failure to Meet IRS Requirements

Unsurprisingly, failing to structure or administer the CRT in compliance with IRS rules can cause major issues.

#4. Choosing the Wrong Trustee

Charitable Remainder Trust law is something of a specialty. You want to make sure your trustee knows what they’re doing. If you serve as your own trustee, you must do your homework to ensure you comply with the rules.

#5. Overlooking Inflation

Depending on the setup, a Charitable Remainder Trust can expose you to inflation risk over the long-term.

#6. Unrealistic Investment Returns

A common tactic used by some advisors selling CRTs is to compare hypothetical tax-deferred returns within the trust to those earned outside of it. One way to “juice” these comparisons is by projecting unrealistic investment returns.

The higher the proposed return, the more attractive the structure may appear—but it can set false expectations. Over 10 or 20 years, this can cause significant problems for clients if the reality falls short.

#7. Complexity and Costs

Like any tool, you need to confirm the benefits outweigh the costs. A big part of that is determining how much you can contribute to the trust upfront.

(This applies to many planning tools—PPLI, PPVA, offshore trusts, offshore LLCs, etc.)

#8. Lack of Flexibility

Sometimes clients don’t realize a CRT is irrevocable. Once you move your assets into the trust, there is no legal way to claim them back if your situation changes.

#9. Miscommunication with Beneficiaries

As we do more and more Family Office work (i.e. helping generations of families, set up and manage their planning), we’ve noticed a distinct lack of communication from one generation to the next.

This is important to get right, especially in structures like this. The last thing you want is a family torn apart because the assets they thought were coming their way go somewhere else.

#10. Poor Coordination with Estate Plan

Any strategy—especially for estates—must fit your broader goals. Like any financial tool, it involves trading one risk for another. A well-rounded approach balances these risks against each other and creates something more resilient in the end.

Frequently Asked Questions

How much income can you take from a charitable remainder trust?

The income depends on the trust type and payout rate. A CRAT pays a fixed amount yearly based on the trust’s starting value. A CRUT pays a percentage of the trust’s value, recalculated yearly. Payout rates are typically 5%–7% and must follow IRS rules to ensure the charity gets at least 10% of the trust’s starting value.

How do you set up a charitable remainder trust?

In a nutshell, you first need to draft the core trust agreement, called a trust deed or trust instrument. During this process, you’ll choose the type of CRT, the payout terms, and the beneficiaries. You’ll also need to appoint a trustee to manage the assets or learn how to do it yourself. After that, you’ll fund the trust and work with your accountant and other advisors to ensure everything remains compliant with the IRS.

How does creating a charitable remainder trust help family members financially?

A CRT can provide income to family members if they are beneficiaries. It also avoids capital gains taxes when selling appreciated assets, keeping more money in the trust for payouts.

Plus, it reduces estate taxes by removing the assets from your taxable estate. That can help if the value of your estate exceeds the federal estate tax exemption ($13.61 million for individuals / $27.22 million for married couples in 2025; $13.99 million for individuals / $27.98 million for married couples in 2025).

How much does it cost to create a charitable remainder trust?

The costs vary a lot. At the low end, you can expect around $3,000-$4,000 for legal and set up. Depending on complexity, that could increase to $15,000-$20,000.

Annual management costs including trustee and investment fees will land somewhere between 1% and 3% of the trust’s assets.

There will also be compliance and accounting fees depending on a number of factors.

Can you continue to manage the assets inside a Charitable Remainder Trust?

Yes, you can act as the trustee and manage the trust assets, but this comes with significant fiduciary and compliance responsibilities.

For that reason, we rarely recommend it. CRTs are complicated structures and, if not managed properly, can lose their tax-exempt status.

Is a Charitable Remainder Trust Right for You?

If this article has piqued your interest and you’re wondering if a CRT is right for you, please book a consultation with one of our Senior Associates. They’ll help you decide whether it’s a possibility and, if so, explain how we can work together.

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…