For the most part, the techniques we’ve used for over 40+ years of planning have changed as the times have changed. Except when it comes to hard assets. We have always believed that gold (and silver) should be a core part of any wealth protection strategy — especially where the threat of bank bail-ins make it unwise to keep all of your money in the mainstream financial system. But which are the best gold bars to buy?

We’ll take a closer look in this article.

What Makes for a “Best” Gold Bar?

On the surface, purchasing gold bars is pretty straightforward. However, there are a few things to consider before you buy anything:

#1: Buy from reputable dealers.

Unfortunately, there are scams out there, especially when it comes to gold bars. So it pays to do your homework. Look for dealers with a long history and a good reputation.

#2: Expect to pay a premium on the purchase.

The price of investment gold is the market price (the “spot price”) plus a premium. That premium can range from 0.5% for larger bars to as much as 5% (or even more) for very small products. These premiums can also fluctuate wildly depending on demand for the metal.

However you buy it, you should expect to pay a premium. Be very careful if anyone ever offers to sell you a gold bar with little or no premium at all, especially if it doesn’t come with proper authentication.

#3: Buy products well known in your area that come with authentication.

And finally, only buy bars that come with an “assay card” or “assay certificate”, presented in a tamper-proof package. Doing so will help you avoid the need to have your bar assayed in future.

Why You Want to Avoid the Assaying Process

The assaying process involves analyzing and verifying that the bar is the metal (and purity) that it claims to be. This process is typically conducted by independent professionals called assayers.

The reason you want to avoid it is that it increases costs when it comes time to selling your gold. In some cases, our clients have paid as much as a few hundred dollars to have this done, even for small amounts of gold.

While there are several ways to assay gold bars, the way it’s often done is a “fire assay,” where the bars are melted down. This process destroys the bar, although you can still sell the gold it contained.

The solution is to buy a reputable product that comes with an “assay packaging.” This is a special type of protection that authenticates the metal. It is designed to assure buyers of the product’s quality and integrity.

Most of the time, it includes an assay card or certificate that contains important information like the refiner’s name, the product’s serial number, its weight, and its purity.

The packaging itself is often tamper-evident. This further ensures the security of the enclosed precious metal.

If, for some reason, the product is removed from its packaging, that’s a red flag for any buyer to insist on an assay.

Best Gold Bars to Buy

When most people think about investing in gold, they tend to start with coins. They’re smaller and more affordable than the traditional bars you might remember from old spy movies.

But over the past few decades, the business has changed a lot. Bars are now available in pieces as small as a single gram (0.035oz) and can be bought very easily both online and in retail stores. (You can even buy small gold bars at Costco no less!)

Although there are still plenty of scams, the business has also professionalized quite a lot. There are well established brands with good reputations. Certain brands that are better known than others, and that we consider the “best” for most investors. Here are some of our favorites.

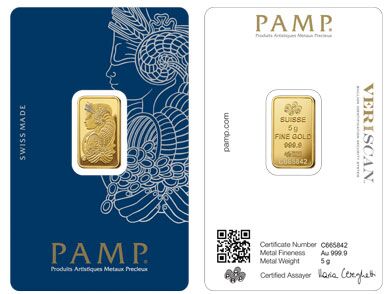

#1: PAMP Suisse Gold Bars (Castel San Pietro, Switzerland)

PAMP Suisse, officially known as Produits Artistiques Métaux Précieux, is a Swiss company that specializes in precious metals and related services. Founded in 1977, it has become a leading bullion brand, recognized for its high-quality gold bars and other precious metal products.

They are best known for their iconic Lady Fortuna design, which was the first decorative motif to ever adorn precious metals bullion.

You’ll find .9999 (99.99% pure) gold bars from 1 gram (0.035oz) to 12.5 kilograms (440.925oz).

These bars come with an assay certificate to assure investors of their authenticity and purity. PAMP Suisse’s products are widely accepted and recognized for their liquidity and investment value.

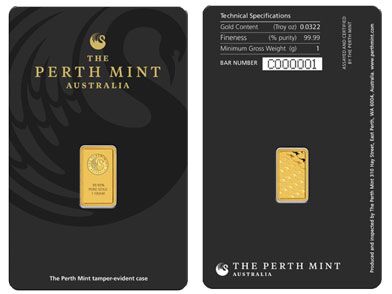

#2: Perth Mint Gold Bars (Perth, Australia)

The Perth Mint is Australia’s oldest operating mint, established in 1899.

The mint offers .9999 gold bars in sizes ranging from 1 gram (0.035oz) to 1 kilogram (35.274oz). Each bar comes with a certificate of authenticity, ensuring its purity and weight.

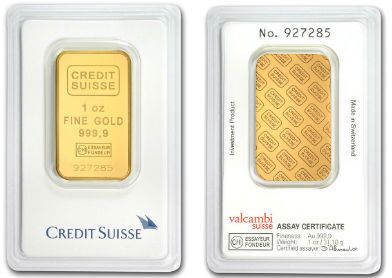

#3: Credit Suisse Gold Bars (Zurich, Switzerland)

Credit Suisse, based in Zurich, once offered a range of .9999 gold bars through its precious metals division. Now that Credit Suisse has been acquired by Swiss banking giant UBS, the bars are no longer being manufactured.

That said, there is a big secondary market for these bars. They are available in sizes from 1 gram (0.035oz) to 10 ounces (283.495g). Each bar features the Credit Suisse logo and is accompanied by an assay certificate, verifying its authenticity and purity.

Other Gold Bar Suppliers

There are many other names out there too including:

- Valcambi Suisse Gold Bars (Balerna, Switzerland)

- Argor Heraeus Gold Bars (Mendrisio, Switzerland)

- Scottsdale Mint Gold Bars (Scottsdale, Arizona)

- Asahi Gold Bars (Tokyo, Japan)

- Johnson Matthey Gold Bars (London, UK). This company was acquired by Asahi in 2014, but there is still a big secondary market for its gold bars.

To our knowledge, there is nothing wrong with any of these options. It’s just that we have not recommended them to clients in the past.

Advantages of Buying Gold Bars vs Gold Coins

In the past, there were a number of differences between gold bars vs coins. But over the past few decades, the market has changed and, by and large, there’s not much difference from an investor’s standpoint.

Other than one… Larger gold bars often have lower premiums than equivalent sized gold coins. Gold bars are less costly to produce and sell for closer to the gold’s spot price (i.e. they have a lower premium).

As well, bars are available in larger sizes than coins (which tend to max out at 1oz), making it more affordable for larger gold purchases.

How do Gold Coins compare to Gold Bars?

Generally, gold bars are less liquid than gold coins for the same size. But the same sized bars also tend to have a lower premium above the value of the gold itself, making them more cost-effective. What’s right for you depends on your goals and budget.

Considering buying gold coins for investment as well? For more information on best gold coins to buy, click here.

What About Gold Storage?

So, you’ve decided to buy gold. But how best to store it? Please see our primer on how to store precious metals.

How to Privately Buy Gold

Many of our clients buy gold because they want an asset that’s completely out of the system. That includes any official record of buying it in the first place.

The solution is to pay cash. But take note that, if you make a cash purchase of $10,000 or more from any US business, that business must file a report with the Treasury.

And don’t forget, when it comes time to sell, you still need to report the gain and pay appropriate taxes.

Why Gold?

Here are the top 10 reasons to invest in gold.

Gold IRA vs Physical Gold

Both a Gold IRA and physical gold involve owning physical metals. However, there are notable differences between the two: Each option has specific advantages and limitations. Here’s what you need to know before you decide: Gold IRA vs Physical Gold.

How to Ship Gold Internationally

Shipping gold overseas from the US might sound straightforward. But it can be quite a process. If you’re thinking about it, here’s what you need to know: how to ship gold internationally.

Where to Buy the Best Gold Bars

- Local precious metals retailers: They are a great starting point for buying gold bars. You’ll avoid shipping costs and insurance for mail order purchases.

- Banks: Some banks (especially in Switzerland) may offer gold bars or coins for sale.

- Coin shows: Larger cities will have periodic coin shows with a large number of dealers in attendance. You’ll have a greater choice of bars as well as possibly lower prices.

- Trusted online platforms: Trusted online platforms offer a secure and convenient way to purchase gold bars, with options for delivery and storage.

So what’s the best?

There’s really no right or wrong answer — it depends on how much you’re buying, where it’s going to be stored, and how private you want the purchase to be.

For us, if we’re storing it at home or in a local safe deposit box, we tend to buy from a well-stocked local dealer with a good reputation. If we’re buying for storage out of state or country, we will look for a reputable provider that offers the ability to buy, store, and sell on our behalf.

Gold Bars and Wealth Protection

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth. For its proven record as a wealth preservation tool, gold — coins for small holding and bars for larger ones — has often been a part of that planning.

If you’re looking to use gold for the same purpose, and aren’t quite sure where to start, please book a free, no-obligation call with one of our Associates to see if a wealth protection plan is right for you.