Private Placement Variable Annuity (PPVA): A Hidden Gem

-

Written by Brandon Roe

- Reviewed by Mark Nestmann

-

Updated: April 16, 2025

Contents

- What is a PPVA?

- How PPVAs Work

- Who are PPVAs for?

- Who shouldn't have a PPVA?

- Key Features and Advantages

- PPVAs: Disadvantages and Drawbacks

- How does a PPVA compare to a non-taxable account?

- How does a PPVA compare to a traditional annuity?

- How does a PPVA compare to a PPLI?

- Cost Structure

- Common Myths and Misconceptions

- Conclusion

- Frequently Asked Questions

There are many tax opportunities for the ultra-wealthy. There are also some good options for people with smaller nest eggs. But what if you’re in the middle — you earn a good living or have at least $500,000 in savings and want to save on tax? A Private Placement Variable Annuity may be well worth considering.

It’s an investment vehicle that helps you defer taxes during your working years — like a regular IRA or 401(k) — but with a lot more flexibility built in. Plus, because it’s a type of insurance, it’s got some good asset protection built in.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

In this article, we’ll dive into how this tool works, whether it might work for you, and how to get started.

(Spoiler: This is something we can help US clients with — both on the domestic as well as international side of things. Please get in touch to learn more.)

What is a PPVA?

A Private Placement Variable Annuity is a type of tax-deferred investment structure. In that way, they are similar to retirement accounts. But it offers more flexibility than most retirement accounts. They can also be part of an international plan, helping you move assets internationally.

It’s worth noting that although PPVAs are technically considered annuities, they don’t have to act like annuities. Although billed more like a retirement product, you have the option to build up value over time without ever taking out a dollar.

(There are reasons for and against, which we’ll get to later in this article.)

And although typically administered by an insurance company, a PPVA is not, strictly speaking, life insurance. They don’t have much (if any) death benefit, but are more focused on the investment piece.

It’s really a better version of a traditional annuity — just without the limited flexibility or high fees.

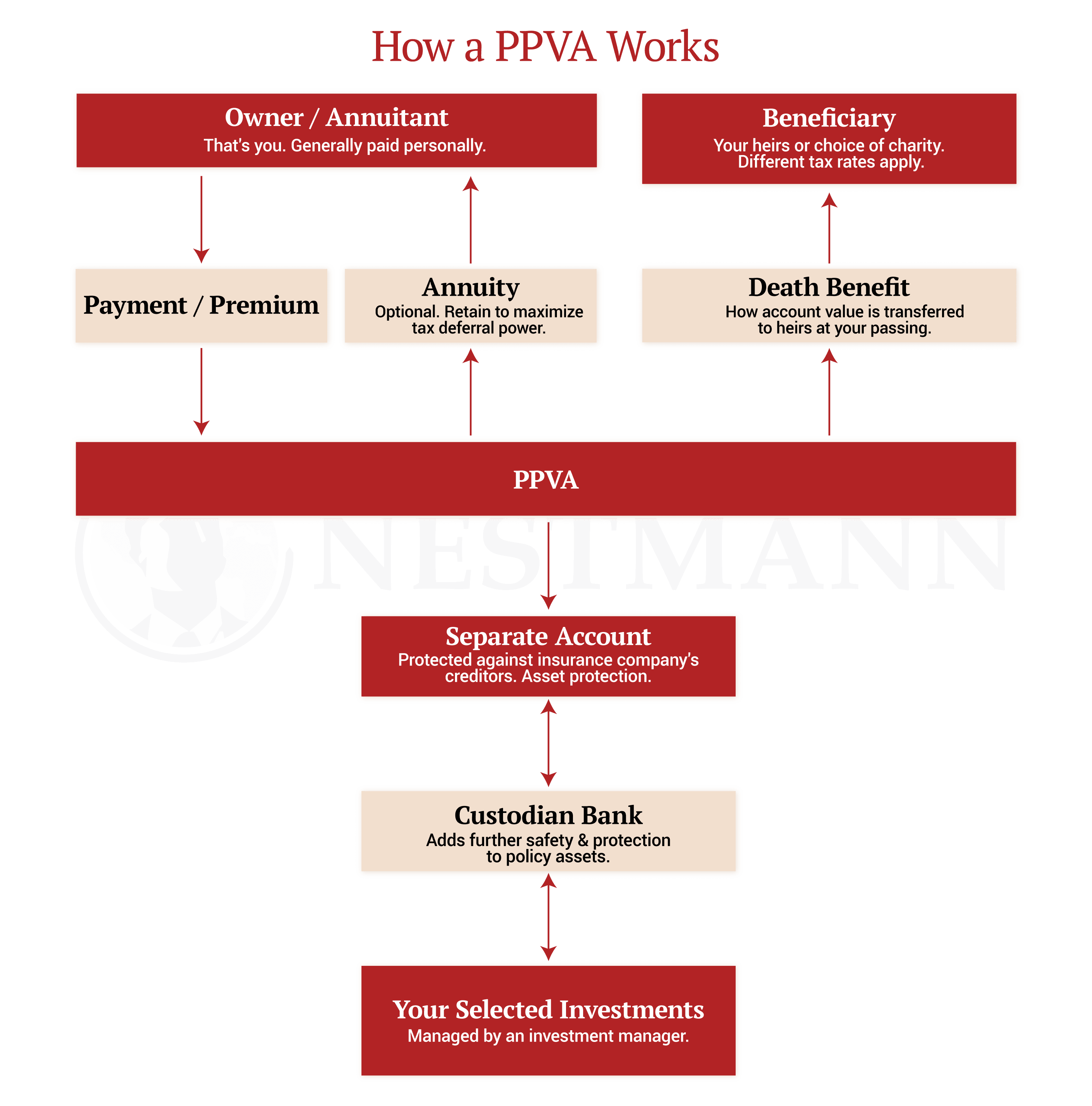

How PPVAs Work

In a nutshell, you work with a firm to create an annuity contract. The firm then engages an investment manager to manage the annuity portfolio on your behalf. (In most cases, you select your investment manager.)

That investment manager then invests the portfolio into asset classes according to your risk profile and preferences. That can be almost anything — stocks, bonds, mutual funds, and ETFs are typical.

But these policies really shine when it comes to alternative investments — hedge funds, more exotic crypto investments, private equity, real estate, commodities, and venture capital.

Behind the scenes, the insurance company takes care of the paperwork to make sure the product stays compliant with the rules.

Here’s model to explain this in visual form:

Who are PPVAs for?

These products are best suited for high-net-worth individuals and families who have at least $500,000 in savings but aren’t “ultra” wealthy (i.e. more than $10 Million).

These policies also tend to work well for people who:

Have maxed out contributions to their traditional retirement accounts.

Want more flexibility to invest in alternative assets.

Want to invest in such assets in a very tax-efficient way.

Have at least $500,000 to invest in a policy (the minimum for many companies).

Who shouldn't have a PPVA?

Too many planners are like hammers looking for a nail. They have their preferred tools and try to fit everyone into it.

But the truth is, no tool is right for everyone. PPVAs are no exception.

This is probably not for you if you…

Want to manage your investments directly.

Don’t mind typical mutual funds or ETFs and haven’t yet used more common tax-deferral strategies like retirement accounts.

Qualify for a Private Placement Life Insurance Policy, which are similar to PPVAs but can offer tax-free opportunities PPVAs cannot.

Key Features and Advantages

As you’ve gathered, there are lots of advantages to these sorts of policies. But to summarize in one place, they offer:

#1: Tax Deferral

PPVAs let your investments grow without being taxed until you withdraw funds. This means your money grows over time without the drag of taxes. This obviously can boost long-term growth.

#2: Highly Customized

Unlike many traditional investment options (including most types of retirement accounts), PPVAs are very flexible. You can invest in a wide range of asset classes and strategies to fit your needs.

#3: Estate Planning

PPVAs can play a useful role in estate planning. They give your heirs certain flexibility that doesn’t exist with other options. For instance, while annuities are included in the estate of a deceased person, the required minimum distribution rules that apply to estate distributions from most IRAs don’t apply to annuities.

#4: Asset Protection

Depending on how and where they are set up, PPVAs offer very strong asset protection — more so than many other strategies.

#5: Privacy

PPVAs offer privacy that other options do not. You have a contract with an insurance company who then goes on to invest through that policy. That shields it from view by potential creditors. (To be fair, though, not from certain regulatory requirements.)

#6: Global Flexibility

PPVAs can be structured in lots of different places and many insurance companies have services that give that access to US clients. Setting up a policy offshore brings certain benefits depending on the jurisdiction.

It is even possible to set up a PPVA offshore without triggering US reporting requirements.

PPVAs: Disadvantages and Drawbacks

As useful as these tools can be, there are certain disadvantages to be aware of.

#1: Estate Planning and Tax

PPVA is a tax-deferral tool, but it can’t avoid tax entirely. This shows up especially when it comes to your heirs — without proper planning, they could face a higher tax bill than if you used other tools to pass on your wealth.

(That’s one of the reasons we prefer to involve the whole family in our planning. Assuming they’re old enough, the feedback of your kids and grandkids can be quite important. If you’re interested in exploring this, please get in touch.)

#2: Regulatory Considerations

By and large, governments tend to leave insurance contracts alone — they don’t want to be seen as picking on someone’s grandma. (That’s the classic view of the typical insurance client, even if not technically true.)

For that reason, the rules and regulations around such things tend to be fairly static. Changes tend to be grandfathered in. But still, regulations can change.

This can be mostly headed off with the right advisors in place. But it’s still something to be aware of.

#3: Not a DIY

Unlike other retirement options, this is not something you’ll want to do on your own. It’s advanced planning and needs to fit into the larger picture to work properly. There are also plenty of rules to follow to keep them compliant.

How does a PPVA compare to a non-taxable account?

How does a PPVA compare to a traditional annuity?

Not much, actually. You can think of a PPVA as more like a tax deferred investment account. A traditional annuity is a financial product offered by insurance companies that provides a guaranteed income stream — usually for life.

Traditional annuities will start paying out at a certain point. PPVAs have no such requirement.

How does a PPVA compare to a PPLI?

| PPVAs | PPLI | |

| Tax | Tax-deferred until withdrawal | Tax-free (if structured right) |

| Recommended net worth | $2,000,000+ | $10,000,000+ |

| Minimums | Generally $500,000 | Generally $3,000,000-$5,000,000 |

| Useful for |

|

|

| Medical | No medical needed (because although it’s an insurance product, it’s not technically insurance.) | Medical exam needed (although there are options if you’re in poor health.) |

Cost Structure

PPVAs generally have the following fees:

Setup Fees

What the insurance company will charge to set up the annuity on your behalf. Fees vary widely depending on complexity and jurisdiction, but usually range between 0.5% and 1% of premiums paid in.

Administrative Fees (Contract Charges)

Fees charged by the insurance company for managing and servicing the policy. It’s usually a percentage of the assets within the policy and rarely more than 0.5% to 0.7%. Usually billed once a year.

Investment Management Fees

The fee charged by the investment manager who manages the asset within the policy. This manager is separate from the insurance company but overseen by the insurance company. If you work with the right advisor, fees are on par with a typical American advisor working with a regular investment account in your name — around 1% is pretty standard.

This fee is paid by the policy to the manager directly.

Custodial Fees

Depending on your investment manager, the policy may have to pay a custodial fee to the bank holding the funds being managed. It’s generally a good idea to ask for this as it keeps your investments safer.

But there is a fee involved, which usually ranges from 0.2% to 0.4% per year depending on policy size, the bank involved, and where it’s located.

Common Myths and Misconceptions

Because Private Placement Variable Annuities aren’t well understood by most people, there’s a fair bit of myths and misconceptions out there. Here are some of the most common:

#1: PPVAs aren’t traditional annuities.

They can be structured to provide an annuity. But they’re more commonly used as a more flexible version of a tax-deferred retirement account.

#2: PPVAs aren’t insurance.

Although issued by an insurance company and called “policies”, they aren’t technically insurance because they don’t (usually) have a death benefit. The upside is that there’s no medical requirement.

#3: PPVAs aren’t tax-free.

They are tax-deferred. If you pull it out, the gains are taxed as ordinary income. Like a traditional retirement account, you may be subject to a penalty if you take gains early. And when it comes time to pass it to your heirs, it will avoid estate tax in most cases, but your heirs will need to pay tax as they pull money out of the policy.

Conclusion

As you’ve figured out by now, PPVAs offer some unique planning opportunities. They can be a powerful addition to a Plan B. But they aren’t for everyone.

If you’re wondering if they could fit into your best Plan B, please book a consultation with one of our Associates to discuss your case.

Frequently Asked Questions

What is a Private Placement Variable Annuity?

A PPVA is a tax-deferred investment tool for high-net-worth individuals and families. They offer flexibility, privacy, and estate planning benefits. You can invest in many different types of asset classes.

How do PPVAs differ from traditional annuities?

PPVAs offer more investment options, lower fees, and no mandatory withdrawals. They focus on tax-deferred growth rather than guaranteed income.

What are the tax benefits of PPVAs?

PPVAs let your investments grow tax-deferred, meaning you only pay taxes when you withdraw funds. However, proper planning is needed to avoid paying more tax than needed on those withdrawals.

Are PPVAs suitable for everyone?

No, they’re best for high-net-worth individuals and family who are looking for more than just retirement accounts, but where Private Placement Life Insurance isn’t the right fit.

How do I choose the right PPVA provider?

If you already have a trusted insurance broker, you can ask them for an internal referral to a specialized team within the firm. However, we strongly recommend working with a planning firm first to ensure the PPVA fits into your wealth protection plan.

How does PPLI differ from traditional life insurance?

Unlike traditional life insurance, PPLI allows for a wide range of investment options, estate planning, and can offer tax benefits. It’s more flexible and can be customized to suit your individual needs.

Who offers Private Placement Variable Annuity insurance?

Many “name brand” insurance companies will do this for qualified clients. However, it’s best to work through an advisor who understands the whole picture before recommending this structure. That way, the tool can be made to fit your needs and requirements.

If you’d like to discuss how we can help you with this, please book in consultation with one of our Associates. You can do so here.

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…