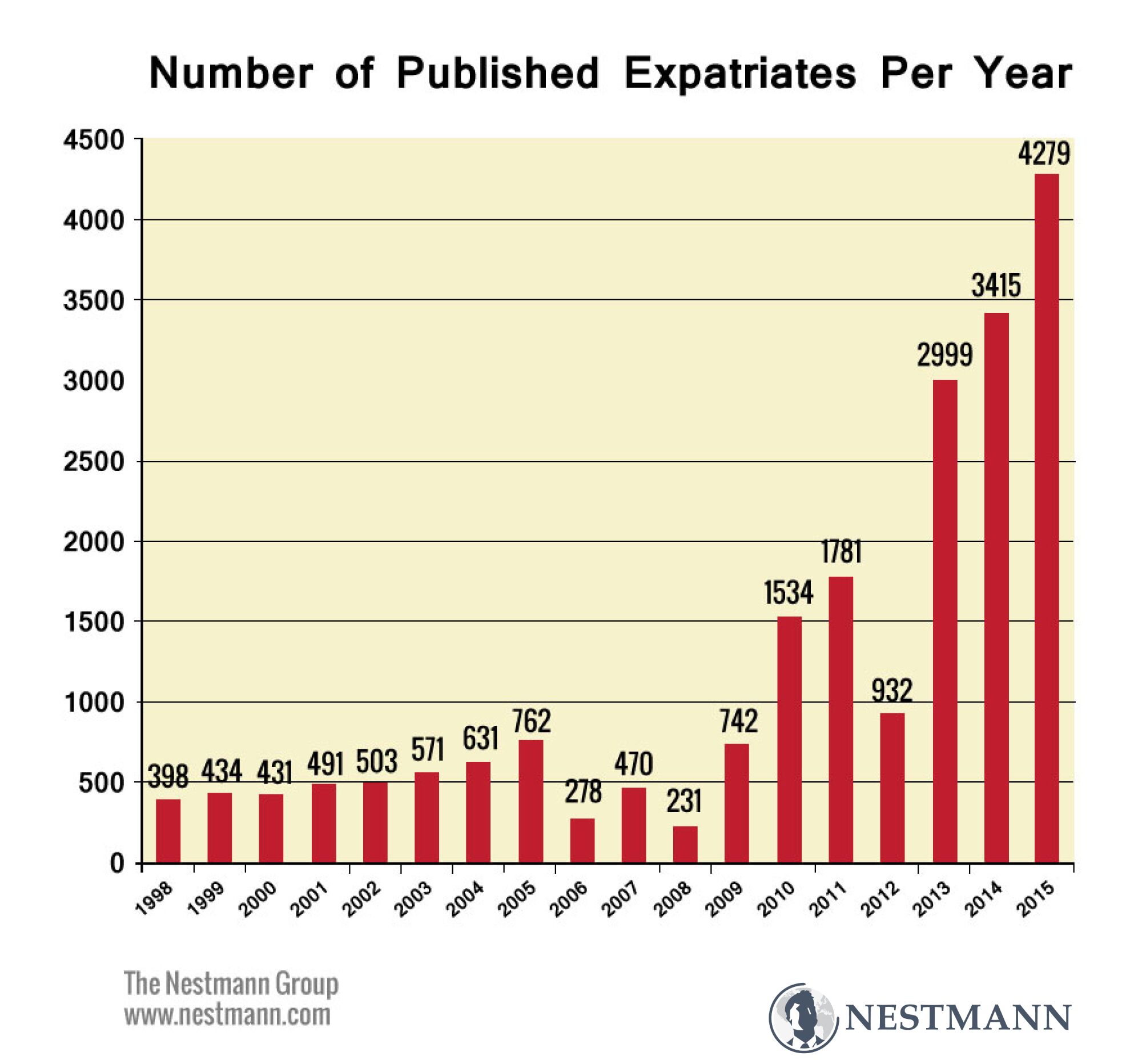

A few weeks ago, the IRS published its quarterly expatriation list in the Federal Register. That’s the list federal law requires the agency to maintain of individuals who give up their US citizenship. The official name is “Quarterly Publication of Individuals, Who Have Chosen to Expatriate.”

Here’s a chart of expatriation trends since 1998, after the law took effect in 1996 requiring the IRS to publish this data quarterly.

Why Are So Many Americans Jumping Ship?

Tax obligations are one reason. But that’s not as much of a factor as you might think. Alone among major countries, the US imposes tax and reporting obligations on all of its citizens, even those living permanently outside the US. Having to file two sets of tax forms annually – one for the US and the other for a citizen’s adopted country – obviously is a burden.

Top 3 Challenges of Being an American Abroad

Another significant reason Americans expatriate is the practical difficulties of being a US citizen living in another country. Worldwide taxes are just the beginning.

#1: Compliance Challenges

Americans living abroad face an overwhelming compliance burden with respect to their non-US investments and business activities. One example is the FinCEN Form 114, the “Report of Foreign Bank and Financial Accounts.”

Failing to file this form could result in a five-year prison term and a fine of $250,000 or more. While sanctions are typically less severe, there are many other mandatory disclosure forms that are easy to miss, all with significant penalties for noncompliance.

Additionally, if an American living abroad owes more than $50,000 in taxes or penalties, the State Department can revoke their passport.

#2: Financial Restrictions

US laws, such as the Foreign Account Tax Compliance Act (FATCA), have made it extraordinarily difficult for Americans living abroad to maintain basic financial and business relationships in their adopted countries.

FATCA forces foreign financial institutions to enforce US tax and reporting rules with respect to their American clients. If these institutions fail to do so, they face a 30% withholding tax on many types of US source income and other capital transfers.

As a result, Americans living abroad report having their bank accounts closed, mortgages called in, and insurance policies canceled. In some cases, employers have even told American employees to renounce their US citizenship within 30 days or face termination.

#3: Retirement Challenges

It is also nearly impossible for an American living abroad to enjoy a normal retirement in their adopted country. This is because, with only a few exceptions, the IRS considers the buildup in value of a non-US retirement plan to be taxable.

Are You A Good Candidate for Expatriation

To expatriate is a big decision. One that has implications far beyond possibly paying an “exit tax” upon your permanent departure.

Expatriation means, for example, that you no longer have the automatic right to enter or live in the United States. You’ll need to get a visa to do so, unless your non-US passport qualifies you for visa-free entry.

Before making this decision, review several key factors to ensure it’s the right choice for you.

You can find more information here: Are you a good candidate for expatriation?

How to Get a Second Passport: 7 Legal Ways

Thinking about a second passport? There are just seven official (legal) ways to get one. Find out which one is the best option for you: How to get a second passport.

Need Help?

We can assist in every phase of giving up your US citizenship or long-term residence. This includes helping you get a second passport before giving up US citizenship.

And if you’re not ready to expatriate, we can help you take advantage of tax breaks in the Tax Code that apply to US citizens and permanent residents living overseas.

Schedule a free no-obligation consultation with a Nestmann Associate to see if expatriation is right for you.

How To Stop Paying Taxes Legally (8 Ways from Easiest to Hardest)

No one likes taxes but you don’t have a choice. Or do you? In this article, we talk about 8 ways to legally reduce, defer, or stop paying taxes entirely.

For more information, visit: how to stop paying taxes legally.