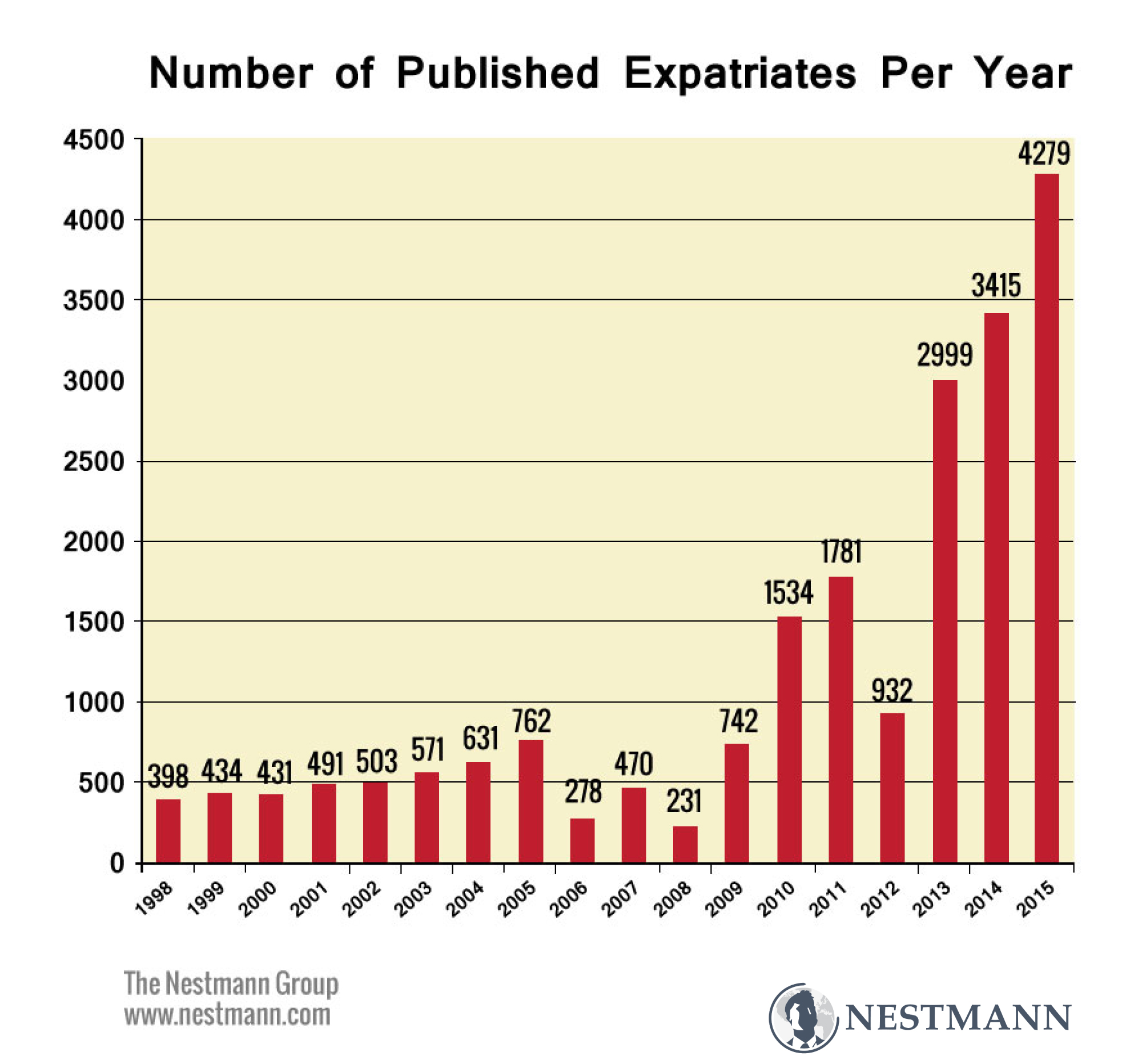

Earlier this month, the Federal Register published its quarterly list of former US citizens and permanent residents who have expatriated. The published data comes from the IRS, which has tracked expatriation trends since 1998.

The number of people giving up their US citizenship and passport for the fourth quarter of 2015 came to 1,058. For all of 2015, the total came to 4,279. This was an all-time record, beating the former record set in 2014 (3,415 expatriates) by 25%.

Here’s a chart of expatriation trends since 1998, after a law took effect in 1996 requiring the IRS to publish this data quarterly in the Federal Register.

Why Do People Expatriate?

Expatriation is admittedly a radical step. The mainstream media report the culprit is tax. Tax is a factor, but hardly the only one. But it’s certainly a place to start.

US citizens and permanent residents must pay US tax on their worldwide income, even if they live permanently outside the country. The US is one of only two countries with this policy. The other is the one-party dictatorship of Eritrea. (Ironically, until 2013, the State Department’s annual report on human rights throughout the world condemned Eritrea for this policy.)

But worldwide taxes are just the beginning of problems facing US citizens or permanent residents living abroad. A case in point is the overwhelming compliance burden US taxpayers face. The information reporting regime they face is complex, overlapping, and constantly evolving. Even minor violations are subject to draconian penalties.

An example is the FinCEN Form 114, the “Report of Foreign Bank and Financial Accounts.” Fail to file this form and you could face a five- year prison term and a fine of $500,000 or more. True, sanctions typically are much less severe. But many other mandatory disclosure forms exist – all of them easy to miss, and all with significant penalties for non-compliance.

And if you owe more than $50,000 in taxes or tax-related penalties, the State Department can revoke your passport. (For that reason, we expect another big surge in expatriations in 2016.)

Then there’s the issue of US laws such as FATCA, the Foreign Account Tax Compliance Act. These laws force foreign financial institutions to enforce US tax and reporting rules. In the case of FATCA, if these institutions fail to do so, they face a 30% withholding tax on many types of US source income and other capital transfers. In many cases, it’s easier to “fire” US clients than deal with this risk.

Our own experience with expatriated clients backs this up.

- One who had lived in Switzerland for more than 40 years gave up her US citizenship only after all of the banks she dealt with there closed her accounts. They didn’t want to deal with all the reporting requirements the US demands if they accept US account-holders.

- Another client received a letter from the bank that had issued a mortgage for her home in Germany. The letter threatened to cancel her mortgage unless she could prove she was no longer a US citizen. Rather than face a huge balloon payment, she gave up her citizenship.

- A Canadian client contacted us after receiving a bill from the IRS for $20,000. He never owed any US tax because taxes in Canada are higher than in the USA. But a Canadian educational savings plan account he’d set up for his daughter was the problem. Under Canadian law, gains in the account are tax deferred – but not under US law. That led to a big tax bill – and his decision to expatriate.

The fact is, more than 8 million Americans now live abroad. Many of them can no longer hold bank accounts, qualify for a mortgage, or set up a tax-deferred account for retirement or their children’s education. Their only real option is to give up US citizenship, even though most of them don’t want to.

Is Expatriation Right For You?

Clearly, the decision to turn in your US passport or green card is an important one. It requires you to get a second passport, if you don’t already have one. It also requires that you live permanently outside the United States, if you don’t already.

Expatriation means you no longer have the automatic right to enter or live in the United States. You’ll need to get a visa to do so, unless your non-US passport qualifies you for visa-free entry.

Further, if your net worth exceeds $2 million or your average income tax liability for the five years preceding your expatiation exceeds $161,000 or you can’t demonstrate tax compliance for those same five years, you might need to pay an exit tax.

Are You A Good Candidate for Expatriation

Before making this decision, review several key factors to ensure it’s the right choice for you.

You can find more information here: Are you a good candidate for expatriation?

How to Get a Second Passport: 7 Legal Ways

Thinking about a second passport? There are just seven official (legal) ways to get one. Find out which one is the best option for you: How to get a second passport.

Need Help?

We can assist in every phase of giving up your US citizenship or long-term residence. This includes helping you get a second passport before giving up US citizenship.

And if you’re not ready to expatriate, we can help you take advantage of tax breaks in the Tax Code that apply to US citizens and permanent residents living overseas.

Schedule a free no-obligation consultation with a Nestmann Associate to see if expatriation is right for you.

How to Move Out of the US Permanently… From Start to Finish.

Thinking about saying goodbye to Uncle Sam? Here’s everything you need to know about expatriation. The good. The bad. And the often unspoken.

Learn more here: How to move out of the US.